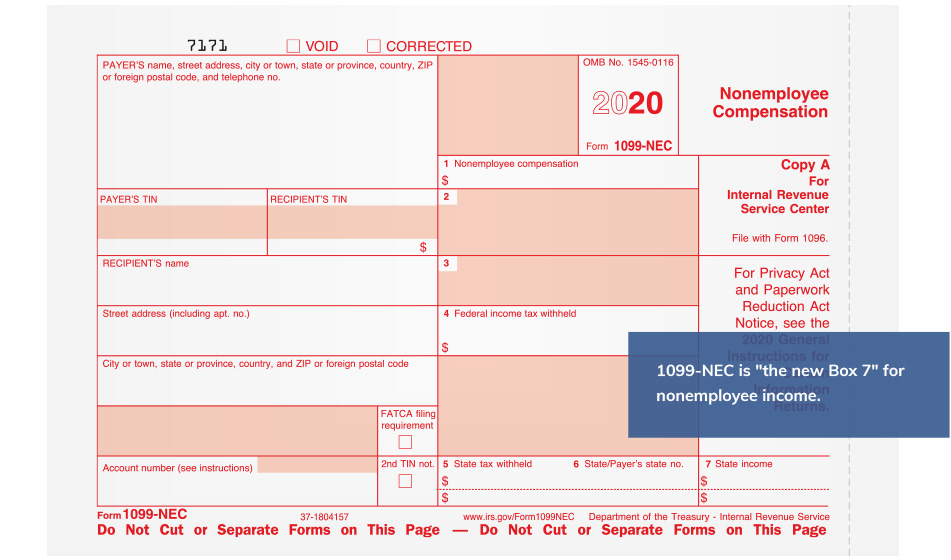

Jul , · With this form, you may also need to complete Form 1099NEC and report the sale again, but in number format If You Withheld Federal Income Taxes for Anyone Under the backup withholding rules, you must file Form 1099NEC for anyone from whom you have withheld federal income tax, regardless of the amount, even if it's less than $600Revenue is reported on the Form 1099Miscellaneous and 1099NEC Income statements for the year in which the check was issued;The 1099NEC form has replaced what used to be recorded on Form 1099MISC, Box 7 You will complete and send a 1099NEC form to any independent contractors or businesses to whom you paid over $600 in fees, commissions, prizes, awards, or other forms of compensation for services performed for your business

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

What is a 1099 nec form

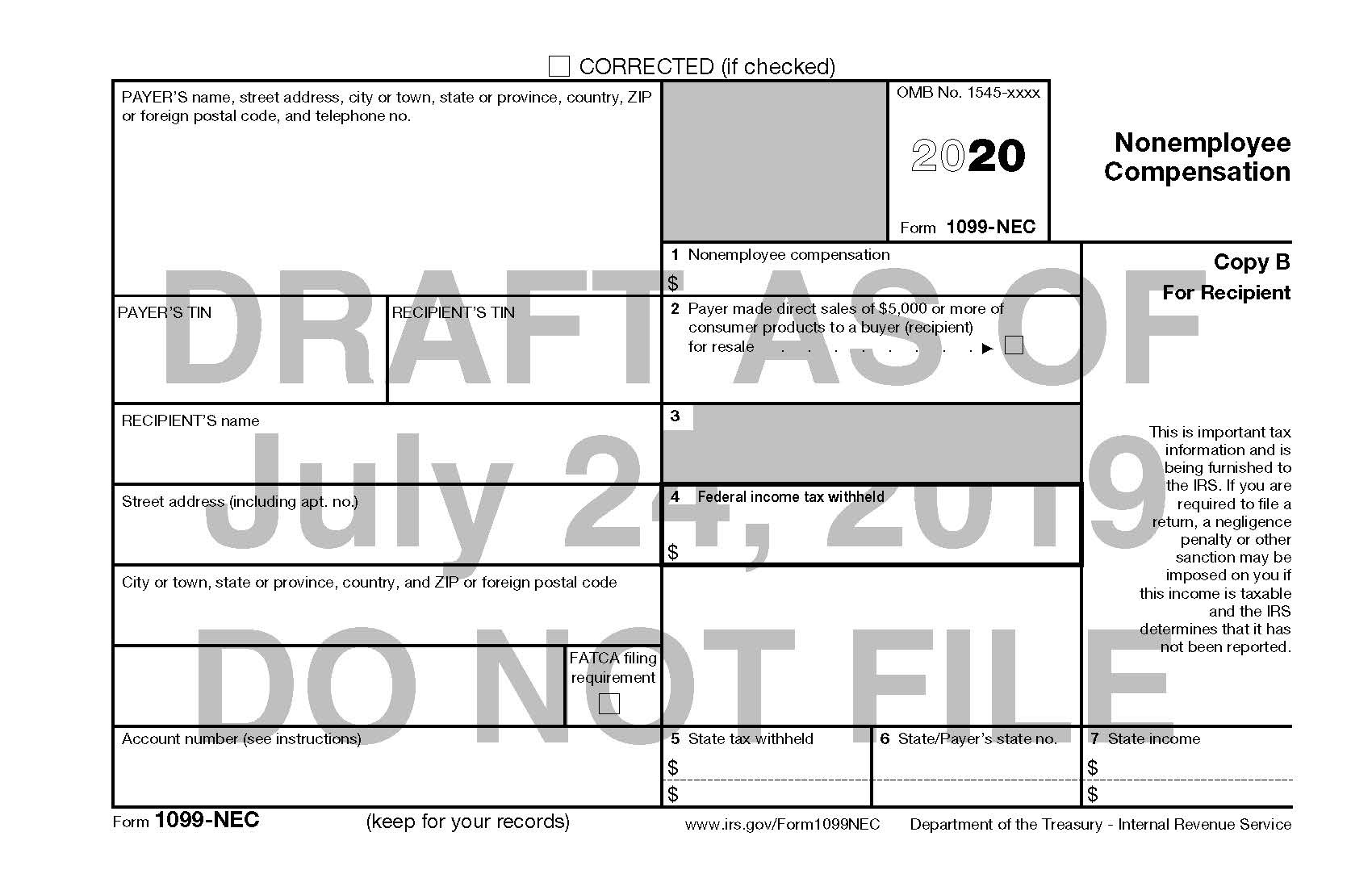

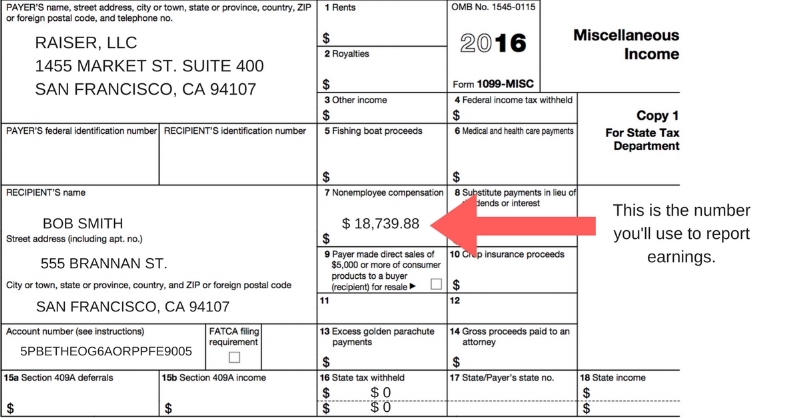

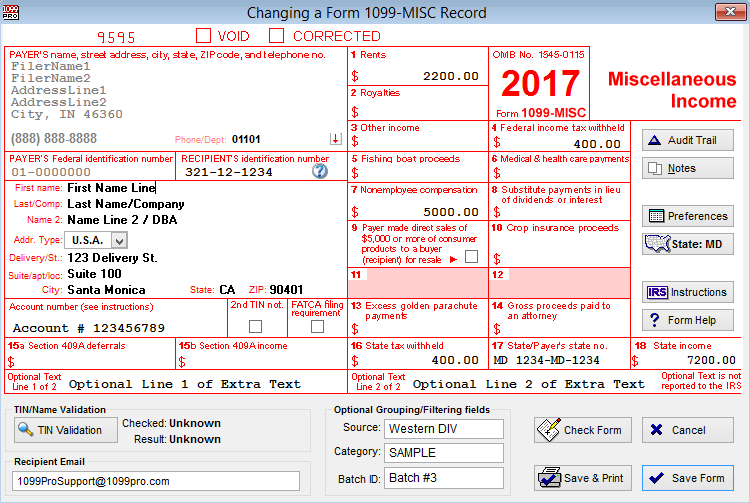

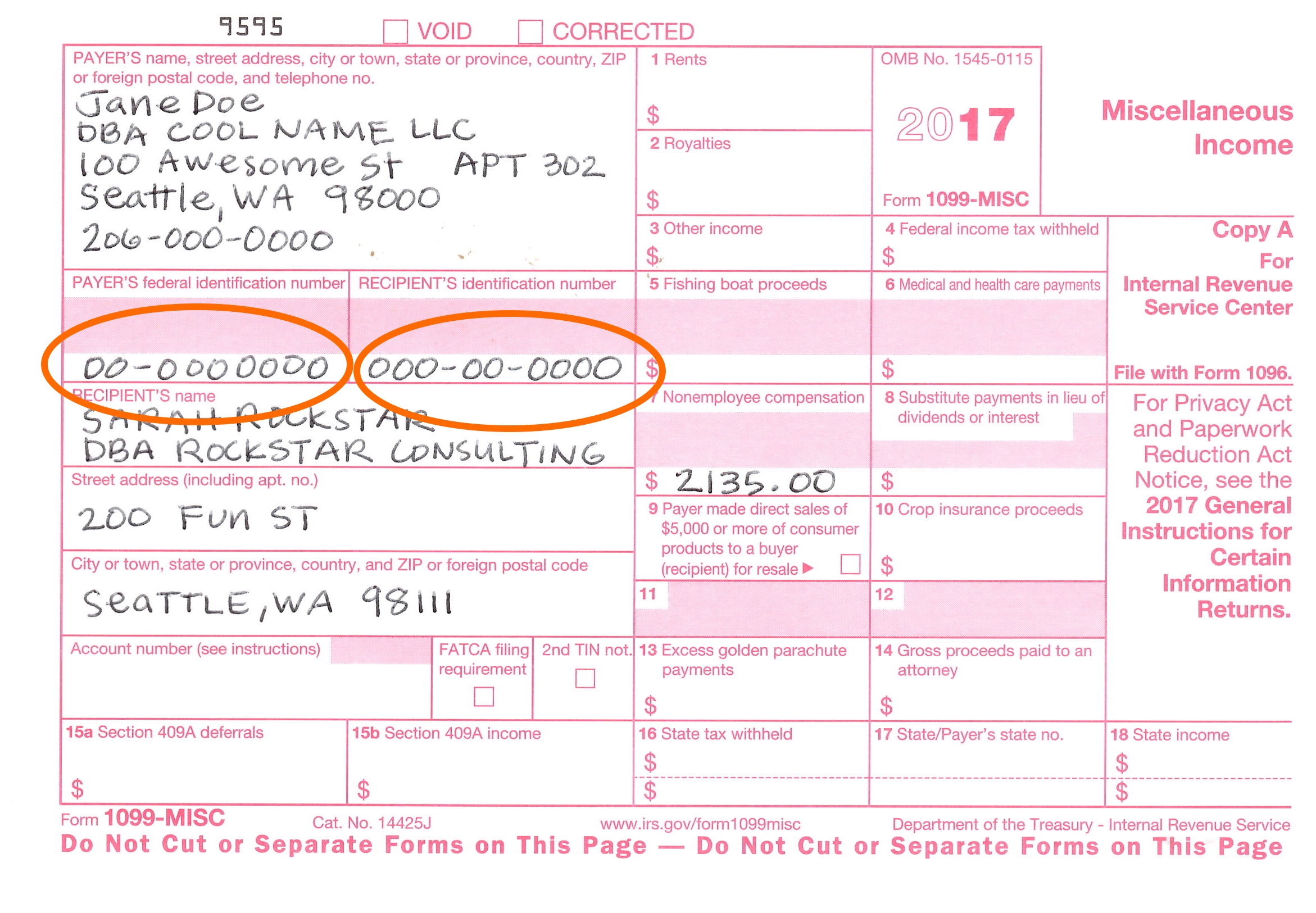

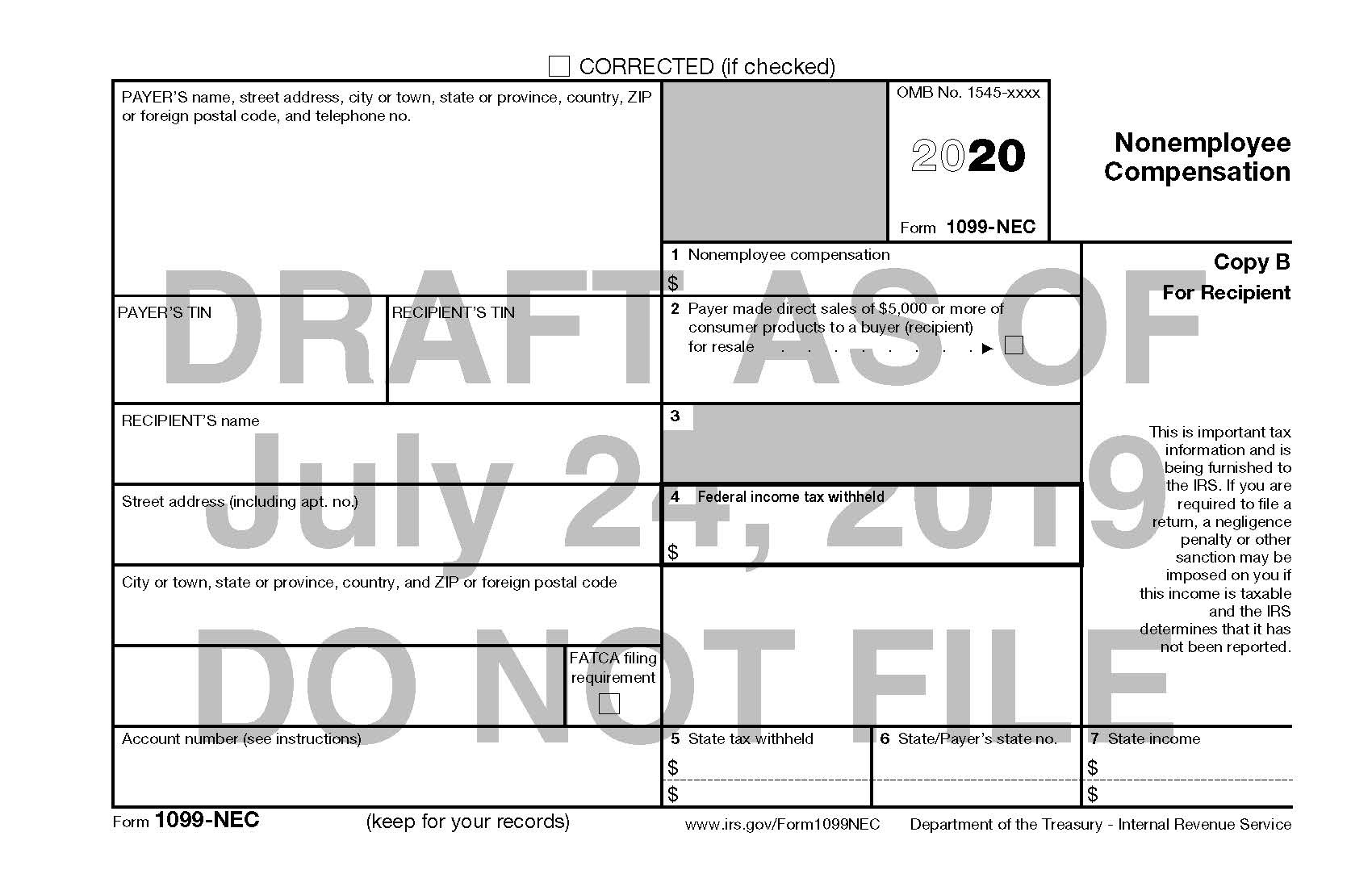

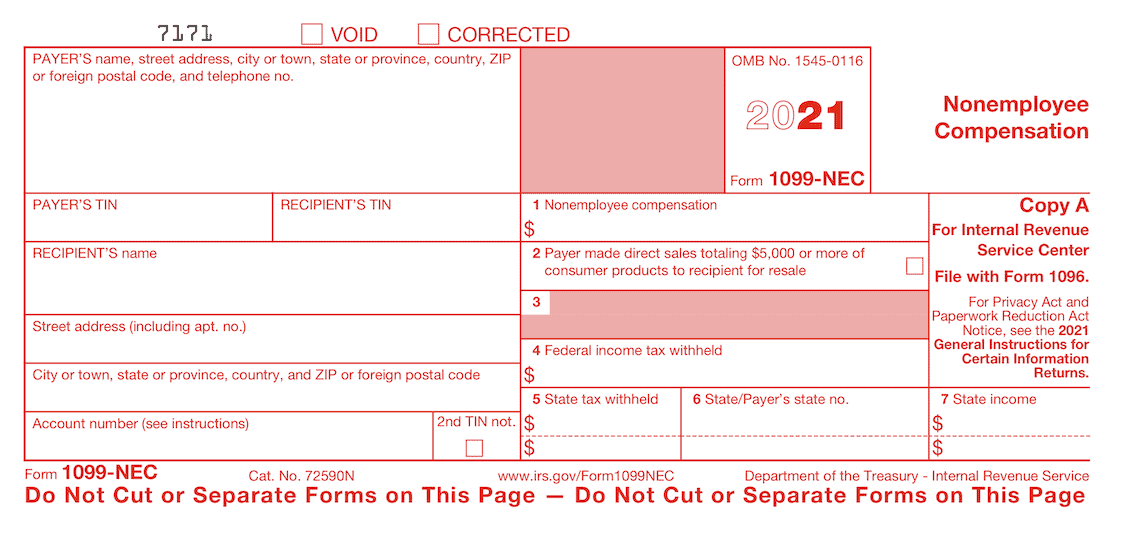

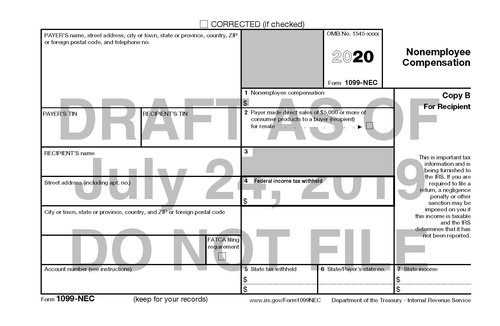

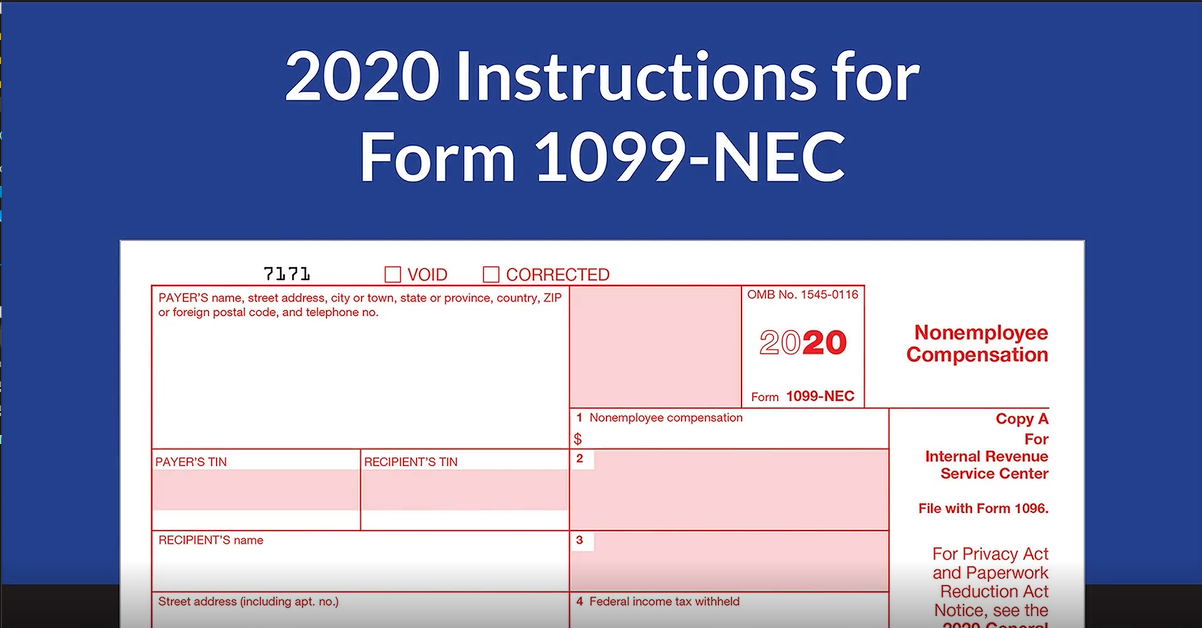

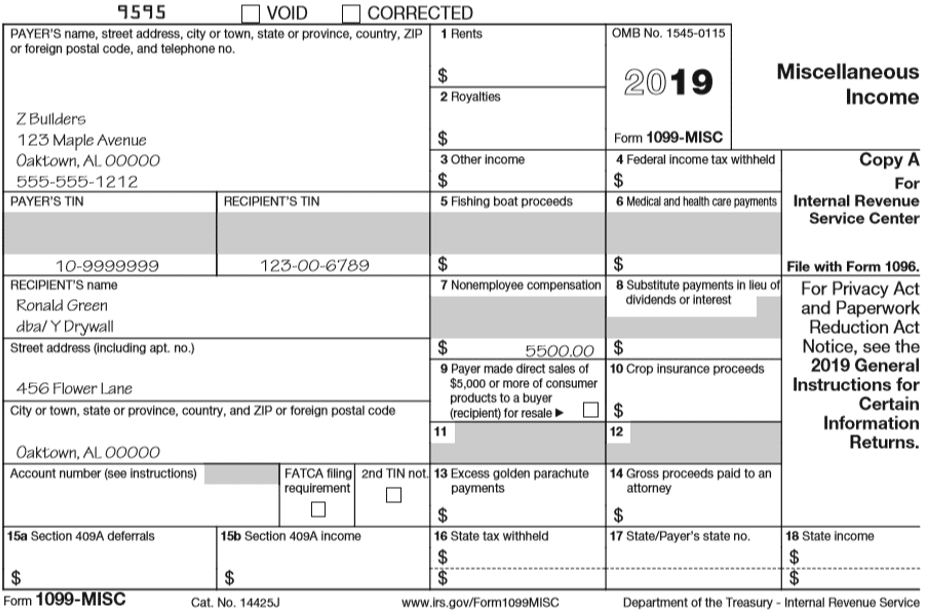

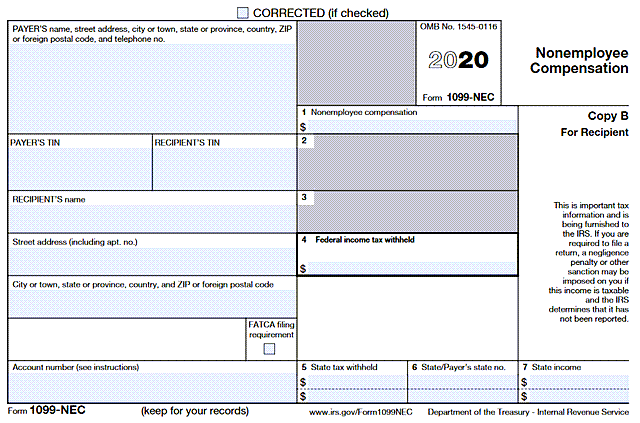

What is a 1099 nec form-Sample 1099NEC The 1099NEC is being introduced for tax year Previously, these amounts were reported on Box 7 of the 1099MISC To read a brief description of a box on the 1099NEC, move your mouse pointer over a box in the sample formYou must also complete Form 19 and attach it to your return If you are not an employee but the amount in this box is not SE income (for example, it is income from a sporadic activity or a hobby), report this amount on the "Other income" line (on Schedule 1 (Form 1040 or 1040SR);

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Jan 08, 21 · Before its reintroduction, the last time form 1099NEC was used was back in 19 Since then, prior to tax year , businesses typically filed Form 1099MISC to report payments totaling $600 orIn 15 the PATH Act moved the due date for Form 1099MISCs that contain nonemployee compensation from February 28 to January 31 The PATH Act also eliminated the automatic 30 day filing extension forFeb 23, 21 · Income reported on Form 1099NEC must be reported on Schedule C, the program is trying to link these two forms together to be sure that it is reported correctly and on the right form Revisit the section where you entered the Form 1099NEC if you entered it on its own and delete that entry, by following these steps Open TurboTax

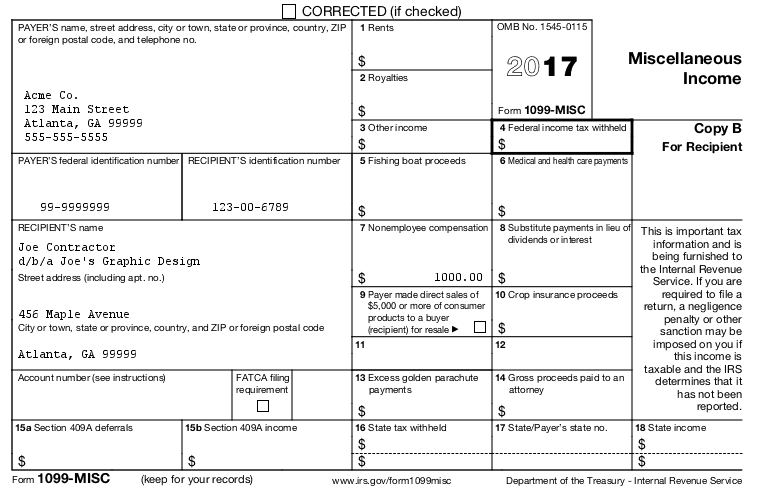

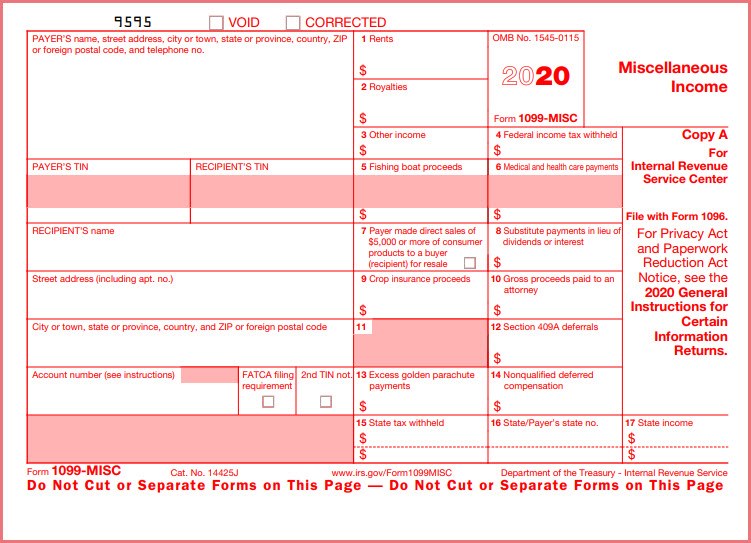

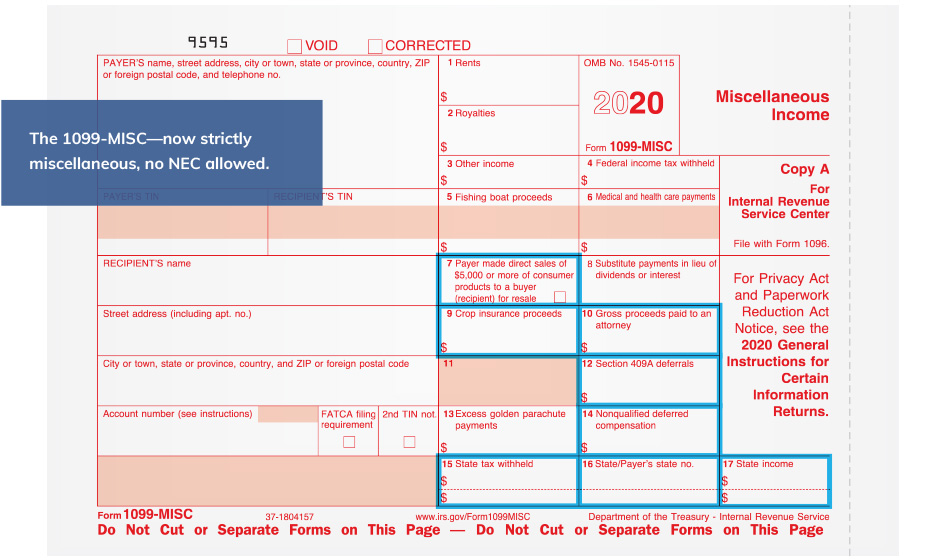

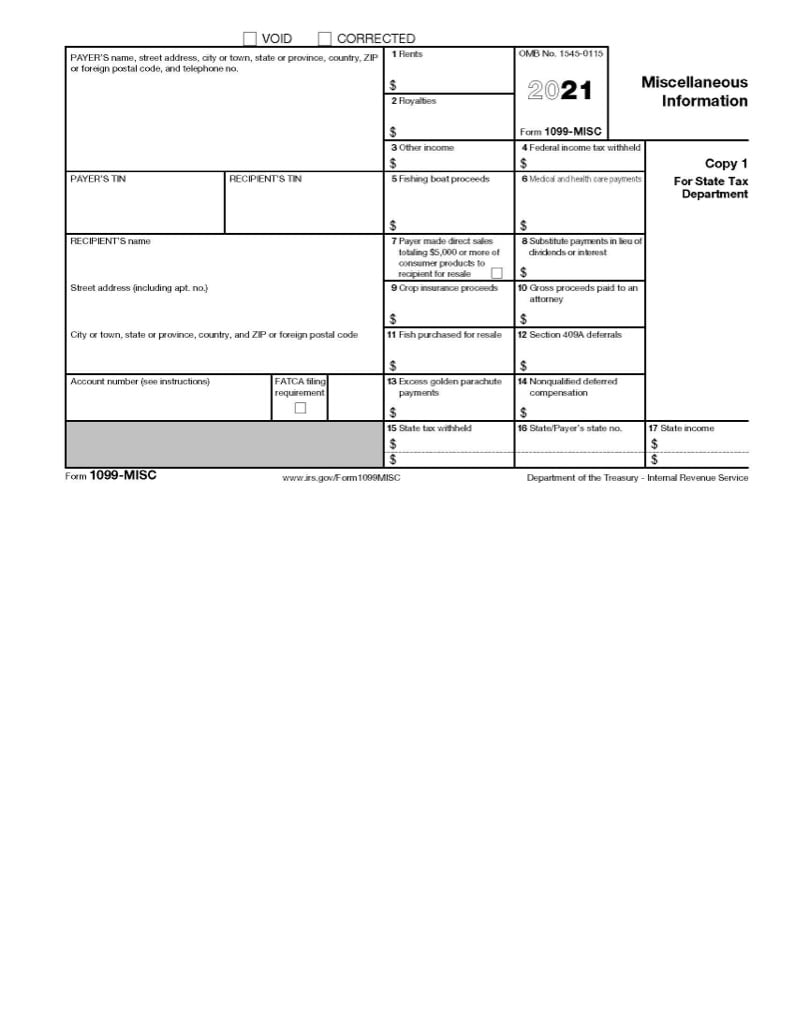

There are several forms that fit into this category, but the big ones are W2s and any type of 1099 filing More than just a cover letter for new filings, Form 1096 correction instructions are used to inform the IRS that previously filed information returns contained errors or omissionsLarry Gray, CPA explains, stepbystep, how to fill out form 1099NEC (NonEmployee Compensation) First, you need to know the old law in order to properly cJan 11, 19 · Form 1099MISC has been redesigned due to the creation of Form 1099NEC and no longer includes box 7 According to the IRS, "The PATH Act accelerated the due date for filing Form 1099 that included nonemployee compensation (NEC) to January 31, and Treasury Regulations eliminated the automatic 30day extension of time to file for forms that

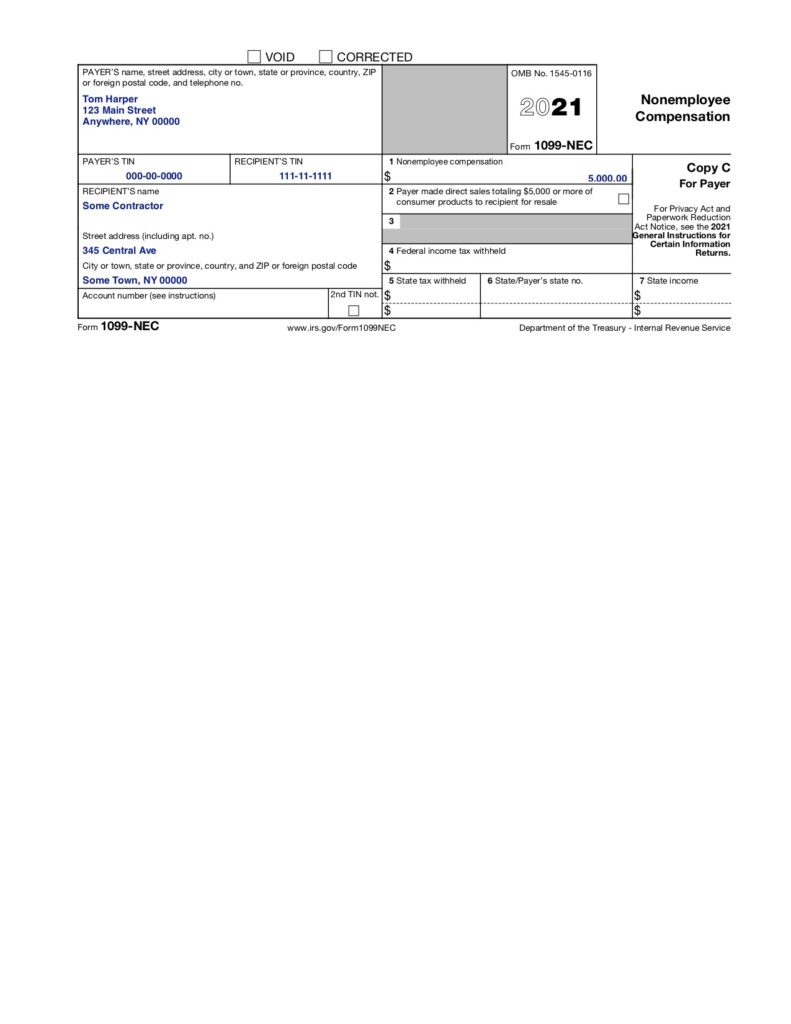

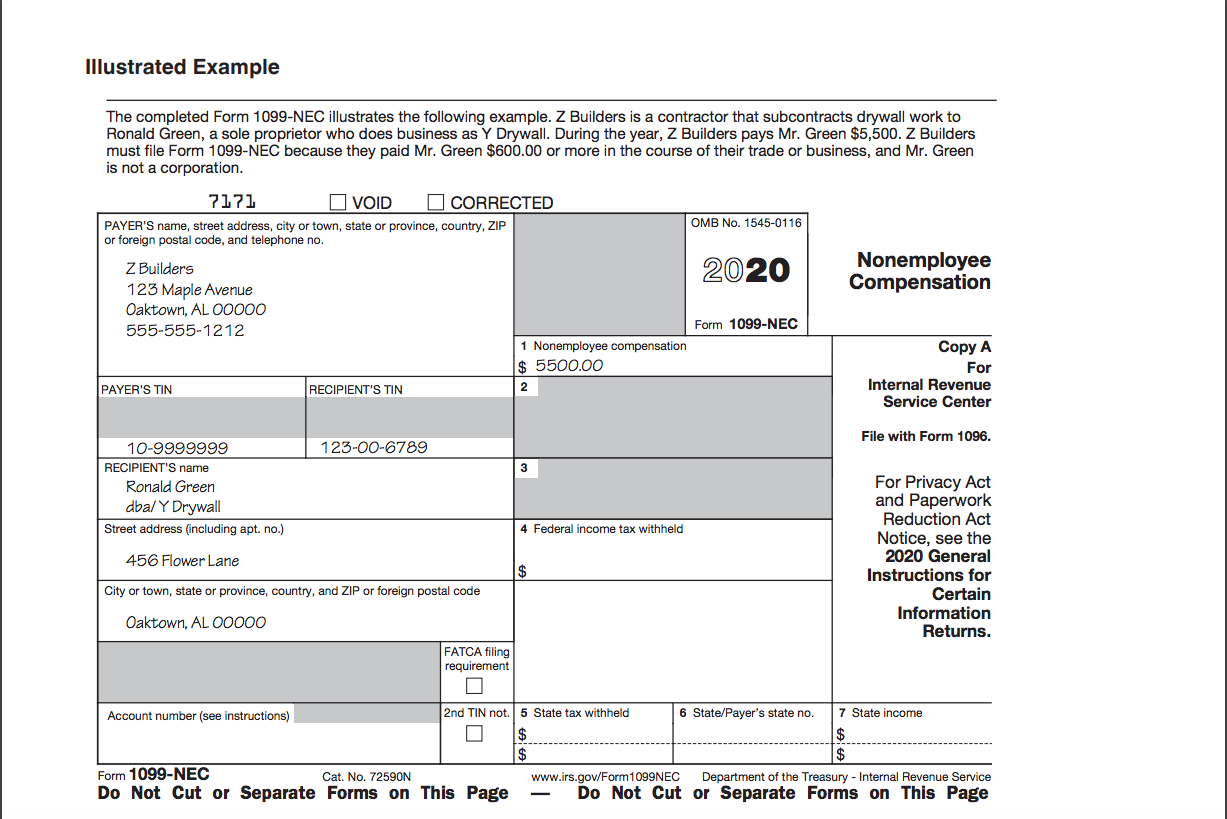

You must also complete Form 19 and attach it to your return If you are not an employee but the amount in this box is not SE income (for example, it is income from a sporadic activity or a hobby), report this amount on the "Other income" line (on Schedule 1 (Form 1040 or 1040SR);Mar 29, 21 · Completing Form 1099NEC Here is the information that must be provided on the form Post the nonemployee compensation to box 1 on Form 1099NEC, and list your company's taxpayer identification number (TIN) as Payer's TIN You'll also list your firm's name and address in the top left section of the formOr on Form Form 1099NEC, call the information

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

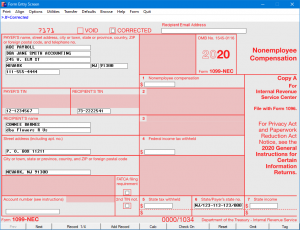

1099 Nec Software 2 Efile 449 Outsource 1099 Misc Software

What is IRS Form 1099NEC?This section provides a sample of the 1099DIV form, which you use to report dividends and distributions 1041 1099DIV Form Sample These are examples of 1099DIV forms for 19 Figure 105 Example of the 1099DIV form for 19 Preprinted Version1 NONEMPLOYEE COMPENSATION 1099NEC, new form starting Formerly Box 7 of 1099MISC 2 1099MISC, Common version Box 3 OTHER INCOME plus

How To Fill Out And Print 1099 Nec Forms

How To File Form 1099 Nec For Contractors You Employ Vacationlord

The IRS has reintroduced Form 1099NEC as the new way to report selfemployment income instead of Form 1099MISC as traditionally had been used This was done to help clarify the separate filing deadlines on Form 1099MISC and the new 1099NEC form will be used starting with the tax yearForm 1099NEC 21 Cat No N 1040SR, or 1040NR You must also complete Form 19 and attach it to your return For more information, see Pub 1779, Independent Contractor or Employee If you are not an employee but the amount in this box is not selfemployment (SE) income (for example, it is income from a sporadic activitySep 17, · Some examples of payments you must report on Form 1099NEC include Professional service fees to attorneys (including law firms established as corporations), accountants, architects, etc Fees paid by one professional to another (feesplitting, for example)

1099 Misc Form Fillable Printable Download Free Instructions

How Do You File 1099 Misc Wp1099

How to Fill Out 1099 Form?Sep 24, · The new form is called the 1099NEC This form, like the W2 and 1099MISC, are due to the contractor by January 31 of each year Specifically, the "NEC" stands for "nonemployee compensation" Payment for these services had previously been reported in Box 7 of the 1099MISC form, but they will now be reported in Box 1 of the 1099NECOct 31, · If you pay any independent contractors for their services, the IRS recently made a change that will probably affect you starting with the tax year, instead of reporting nonemployee compensation (NEC) via Form 1099MISC, you must complete and file Form 1099NEC by January 31, 21 (or the next business day) It's a relatively small change, but you could

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

Your Ultimate Guide To 1099s

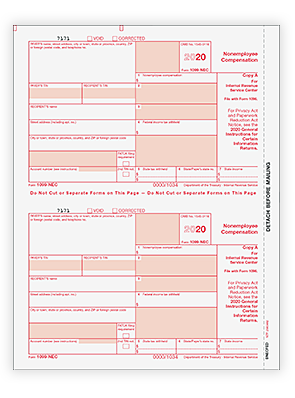

May 30, 21 · Resume Examples > Form > Editable 1099 Nec Form Editable 1099 Nec Form May 30, 21 by Jonas Koertig 21 Posts Related to Editable 1099 Nec Form Editable 1099 Nec Form Editable 1099 Form Editable 1099 Form 17 Editable W 9 Tax Form W 9 Form Editable Editable W 2 Form Free Editable W 9 FormDec 03, · After a 38year absence, Form 1099NEC made its return in the tax year For the last few decades, business owners were responsible for using Form 1099MISC to report nonemployee compensation But with Form 1099NEC, employers can say hello to a revamped form and goodbye to reporting nonemployee compensation on Form 1099MISCFill in the boxes on the 1099NEC Form Click the Question icon or the instructions link to get help Click the 'save' button to save the 1099 information Click the 'Print 1099 Forms' button to print the different 1099 Copies for this recipient ezW2 can print forms 1099nec copy A, B, C, 1 and 2 Click the 'Print Instructions' button to print 1099 instructions Sample Forms;

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

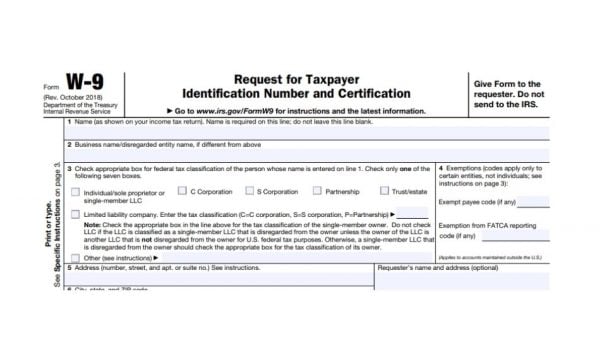

Dec 07, · A 1099NEC will be provided to vendors or subcontractors who worked for a period of time for an employer to complete a project, with total payments exceeding $600 Independent contractors or selfemployed contractors must still fill out a Form W9 offered by IRS in their tax forms sectionJun 30, · You must send the contractors and the IRS a Form 1099MISC—or, starting in tax year , a Form 1099NEC—to notify them about the amount of nonemployee income you paid to the contractors You will use Form 1096 to summarize the information provided on all the 1099MISC or 1099NEC forms you sent to contractorsThe NEC in 1099NEC stands for nonemployee compensation Also known as selfemployment income, nonemployee compensation is income received from a business (the payer) who classifies the payee as an independent contractor rather than an employeeBy instituting the 1099 NEC, the IRS would streamline income reporting for all selfemployed people

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Nov 04, · Filing Form 1099NEC With TaxBandits You can complete Form 1099NEC in a matter of minutes with TaxBandits All you have to do is create your free account and follow the interview style efiling process Helpful tips along the way to explain what information is required to complete your form and where it needs to be enteredPayments made for the services of an attorney must also be reported on the Form 1099NEC The Form 1099MISC was also modified so that it no longer applies to most NEC payments Payments made to a single independent contractor may be split between the two forms, therefore some independent contractors will receive both forms from one businessThe following steps will help you in filing Form 1099 MISC without any concerns Step 1 Collect Accurate Information Beforehand Once you make a payment to independent contractors, ensure you make them complete Form W9 in order to collect the contractor's legal name, address, and Taxpayer Identification Number (TIN) The Taxpayer

An Employer S Guide To Filing Form 1099 Nec The Blueprint

The New 1099 Nec Irs Form For Second Shooters Independent Contractors Formerly 1099 Misc Lin Pernille

Form 1099NEC The PATH Act, PL , Div Q, sec 1, accelerated the due date for filing Form 1099 that includes nonemployee compensation (NEC) from February 28 to January 31 and eliminated the automatic 30day extension for forms that include NEC Beginning with tax year , use Form 1099NEC to report nonemployee compensationJan 25, 21 · You probably received a 1099NEC form because you worked for someone during the past year but not as an employee For example, if you got paid as a freelancer or contractor, the person you worked for is required to keep track of these payments and give you a 1099NEC form showing the total you received during the yearJan 02, 21 · For the tax year, the IRS has introduced the 1099NEC This form is used to make the distinction between nonemployee compensation and other types of payments a business makes As a result, nonemployees will receive a 1099NEC instead of the 1099MISC As with all IRS forms, it can be located on the IRSgov website

1099 Software 1099 Printing Software 1099 Efile Software And 1099 Forms Software

What Is An Irs Schedule C Form And What You Need To Know About It

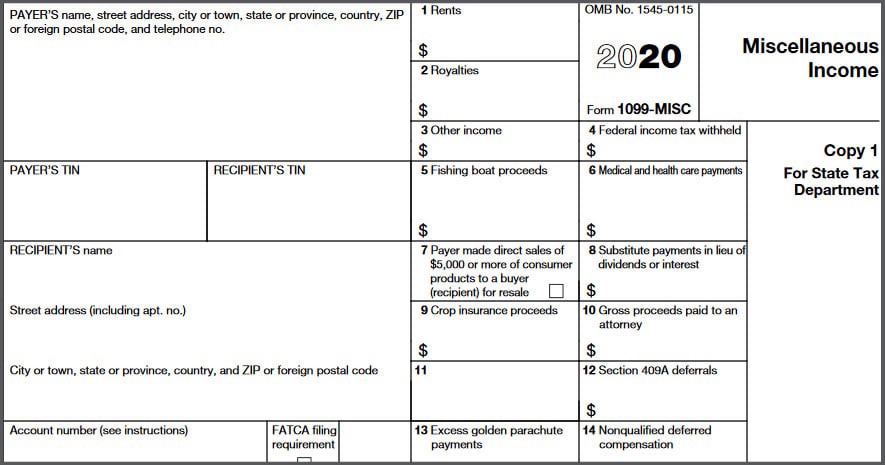

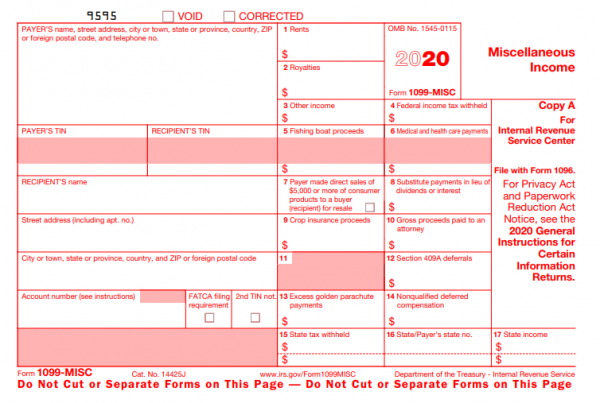

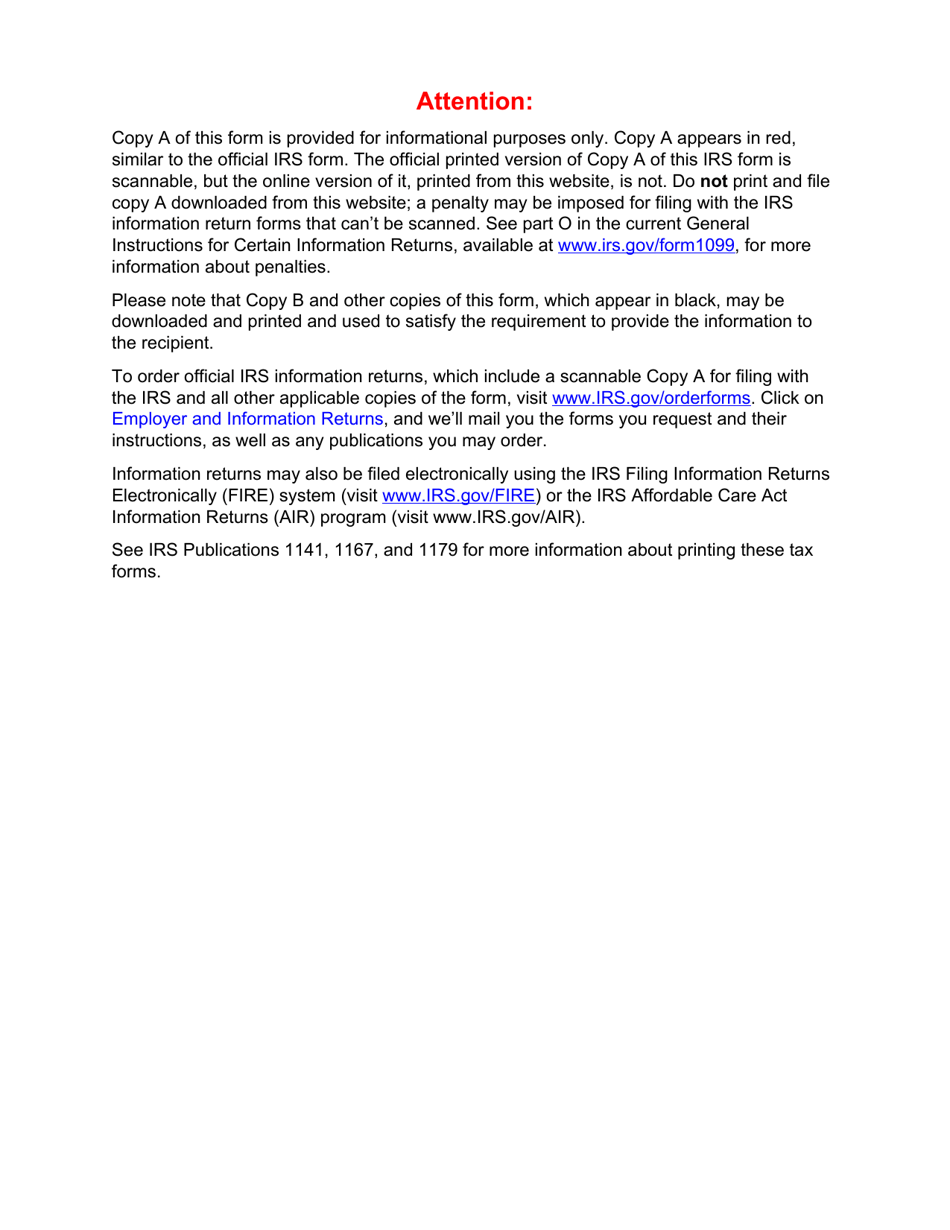

Do not file draft forms and do not rely on draft forms, instructions, and publications for filing) Why is the IRS bringing Form 1099NEC back?Regardless of when the owner received the check In this example, the revenue would be reported on the form Is my Form 1099Miscellaneous and/or 1099NEC Income statement accessible on chkcom?Both Forms 1099NEC 1099MISC Payer Information Box 1 Nonemployee compensation Rents Recipient Information Box 2 Reserved (blank) Royalties Box 3 Reserved (blank) Other income Box 4 Federal income tax withheld Federal income tax withheld Box 5 State tax withheld Fishing boat proceeds Box 6 State/Payer's state no Medical and health care

1099 Nec Software Print Efile 1099 Nec Forms

How To Fill Out And Print 1099 Nec Forms

The information provided to the IRS and to the recipient is the same A copy of the Form 1099NEC is sent to the IRS for processing In general, an employer must file Form 1099MISC (or Form 1099MISC in place of the Form 1099MISC) if the total payments to an independent contractor during the year exceed $600 (or $600 in place of $600)Apr 02, 21 · An example of Form 1099NEC for a selfemployed person Other people who may receive 1099NECs include ridehailing drivers, delivery drivers, freelance writers, graphic designers and otherNov 03, · Form 1099MISC vs Form 1099NEC In the past, businesses had to use Form 1099MISC to report independent contractor payments in addition to the other types of miscellaneous income However in , the IRS brought back Form 1099NEC, Nonemployee Compensation, to report nonemployee compensationBusiness owners used to report nonemployee compensation on Form 1099NEC

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemble The Act Fillable Forms Irs Forms Accounting

Ready For The 1099 Nec

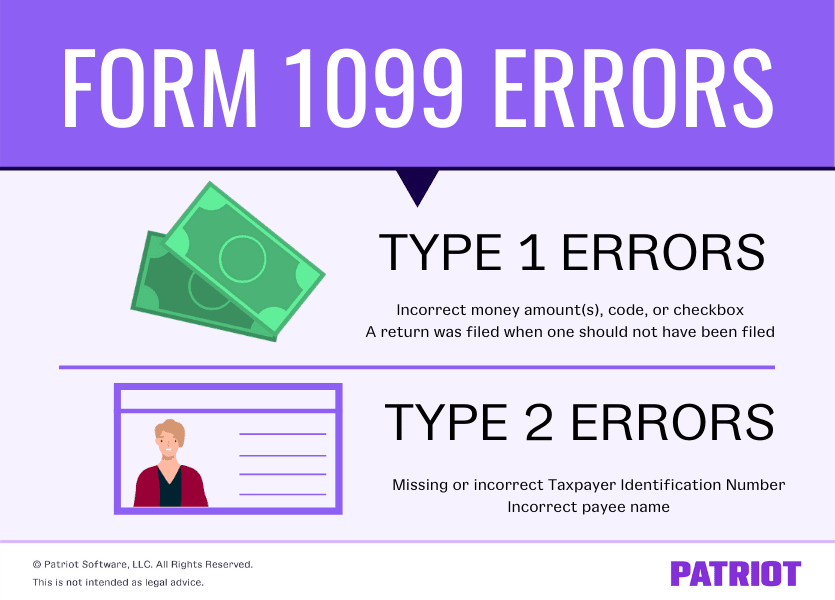

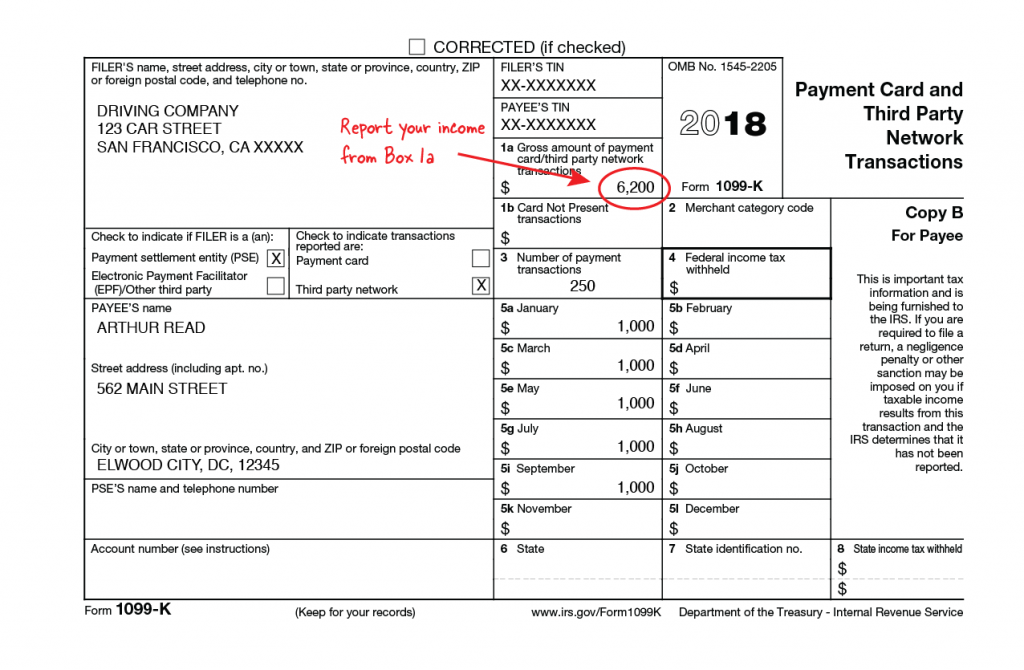

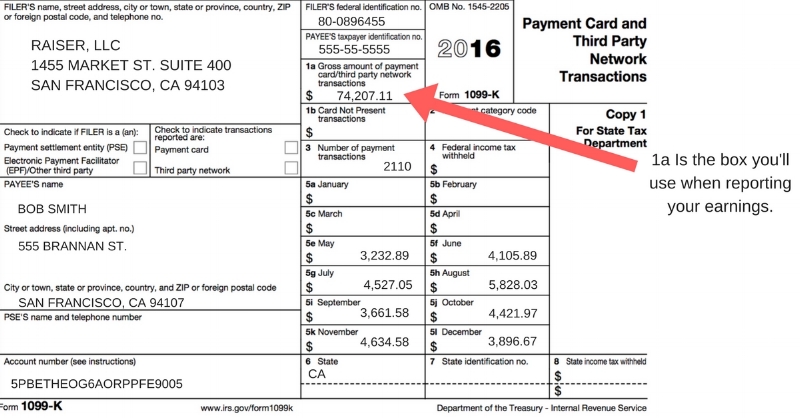

Dec 01, · Unlike Form W2's correction form, Form W2c, there is not a separate 1099 correction form The 1099 correction form is the same as the original form You must use a regular copy of Form 1099 (either NEC or MISC) and mark the box next to "CORRECTED" at the topNext you need to figure out which 1099 tax form you need 1099NEC vs 1099K If you have reported any independent contractor income in the past, you are probably familiar with the Form 1099MISC Income from the tax year is going to be filed on Form 1099NEC, which is replacing the 1099MISC from last yearExamples include graphic designers, Web developers, cleaning professionals, freelance writers, landscapers and other selfemployed individuals Basically, the 1099NEC form is to independent contractors what the W2 is to employees The 1099NEC captures nonemployee compensation, in addition to documenting that you didn't deduct any federal

Why Is Grubhub Changing To 1099 Nec Entrecourier

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

You are required to complete a 1099MISC or 1099NEC reporting form for an independent worker or unincorporated business if you paid that independent worker or business $600 or more You add up all payments made to a payee during the year, and if the amount is $600 or more for the year, you must issue a 1099MISC or 1099NEC for that payeeDec 16, · This process is explained in further detail on the first page of Form 1099NEC 4 Submit form 1096 If you file a physical copy of Form 1099NEC, Copy A to the IRS, you also need to complete and file Form 1096 The IRS uses Form 1096 to track every physical 1099 you are filing for the year The deadline for Form 1096 is January 31, 21 5Nov , · Taxpayer ID Numbers for Form 1099NEC You must have a valid tax ID number for a nonemployee before you prepare Form 1099NEC When you hire a nonemployee, you must get a W9 form from them reporting this and other identifying information you'll need to complete Form 1099NEC Document your efforts to obtain a completed W9 form by keeping

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

The IRS has released the Form 1099NEC that replaces Form 1099MISC for reporting nonemployee compensation (in Box 7) To use the "reinstated" 1099NECAt this time, Form

1099 Misc Form Fillable Printable Download Free Instructions

1099 Nec Form Copy C 2 Discount Tax Forms

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Irs Archives Stees Walker Company Llp Blog

Form 1099 Nec For Nonemployee Compensation H R Block

Corrected 1099 Issuing Corrected Forms 1099 Misc And 1099 Nec

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

How To File Form 1099 Nec For Contractors You Employ Vacationlord

1099 Misc Form Fillable Printable Download Free Instructions

What Is Form 1099 Nec Who Uses It What To Include More

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

The New 1099 Nec

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

How To Fill Out And Print 1099 Nec Forms

How To Fill Out And Print 1099 Nec Forms

1099 Nec And 1099 Misc Changes And Requirements For Property Management

1099 Nec Software Software To Create Print And E File Form 1099 Nec

Freelancers Meet The New Form 1099 Nec

What Is The Account Number On A 1099 Misc Form Workful

The New 1099 Nec

Why Is Grubhub Changing To 1099 Nec Entrecourier

1099 Nec 1096 Template 1099misctemplate Com

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Sample 1099 Misc Forms Printed Ezw2 Software

What Is A 1099 K Stride Blog

Form 1099 Nec Requirements Deadlines And Penalties Efile360

How To Fill Out Forms 1099 Nec New 1099 Form Youtube

When Do You Need To Use Form 1099 Misc Contact Fma Cpa Today

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

1099 Misc Software Software To Create Print And E File Form 1099 Misc

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099 Nec Instructions And Tax Reporting Guide

Order 1099 Nec Misc Forms Envelopes To Print File

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

How To Fill Out A 1099 Nec Check Stub Maker

1099 Nec Form Copy B 2 Discount Tax Forms

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

There S A New Tax Form With Some Changes For Freelancers Gig Workers

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

How To File 1099 Misc For Independent Contractor

State 1099 E Filing Tips

New Nec 1099 Laser Fed Copy A Item 5010

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Form 1099 Nec Instructions And Tax Reporting Guide

Nec5110

1099 Nec Form Copy B 2 Discount Tax Forms

Form 1099 Nec Form Pros

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Nec Tax Forms Discount Tax Forms

1099 Misc Form What Is It And Do You Need To File It

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Form 1099 Misc Archives W9manager

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

Form 1099 Nec How To Fill Out This New Form Youtube

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Nec Form Copy B C 2 3up Discount Tax Forms

1099 Misc Form Fillable Printable Download Free Instructions

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

New Irs Form 1099 Nec Video Ryan Wetmore P C

It S Irs 1099 Time Beware New Gig Form 1099 Nec

How To Fill Out 1099 Misc Irs Red Forms

How To Fill Out And Print 1099 Nec Forms

1099 Nec Conversion In

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Gosling Company Certified Public Accountants

Ken Kramer Author At Inform Decisions

How Do Uber And Lyft Drivers Count Income Get It Back Tax Credits For People Who Work

Can You Handwrite A 1099 Form And Other Tax Form Questions Answered Blue Summit Supplies

How To Fill Out 1099 Nec Red Forms For Irs Return Youtube

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

0 件のコメント:

コメントを投稿